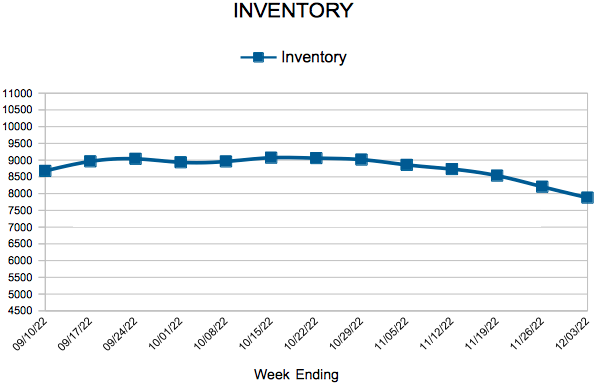

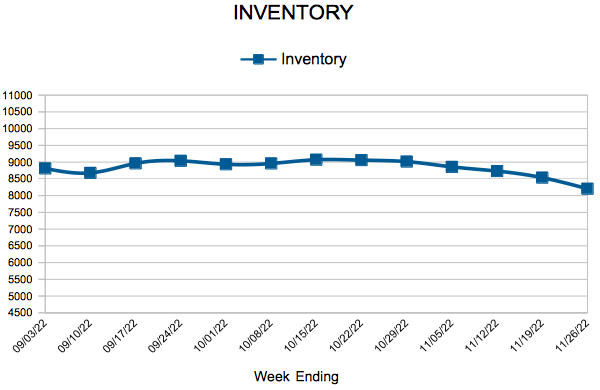

Inventory

Weekly Market Report

For Week Ending December 3, 2022

For Week Ending December 3, 2022

Rising interest rates and higher sales prices have caused affordability to decline significantly this year, and U.S. homebuilders have taken note. New homes have been getting smaller throughout 2022, with the U.S. Census reporting the median square footage of homes under construction was 2,276 in the third quarter of 2022, down 2.5% from the fourth quarter of 2021, when the median square footage was 2,335. The trend toward smaller homes is expected to continue in the months ahead, as homebuyer budgets remain constrained.

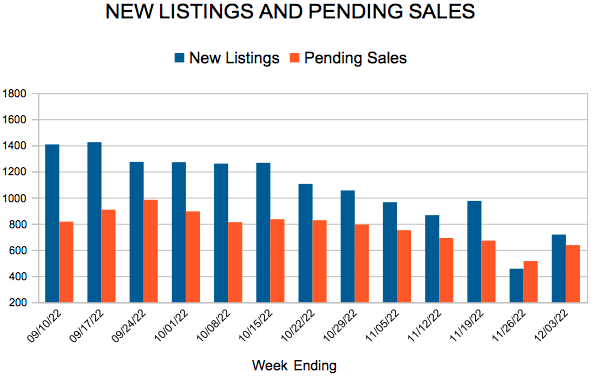

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 3:

- New Listings decreased 18.8% to 717

- Pending Sales decreased 34.3% to 637

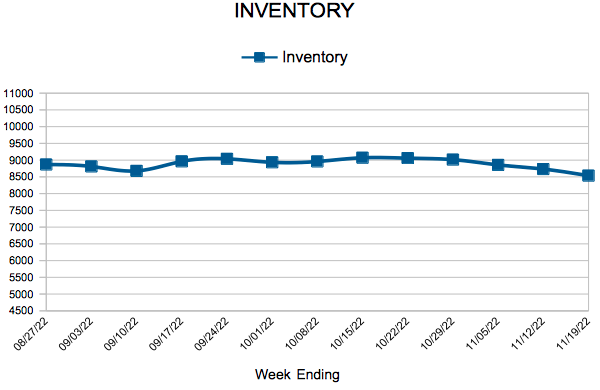

- Inventory increased 14.4% to 7,879

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.0% to 98.3%

- Months Supply of Homes For Sale increased 33.3% to 2.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

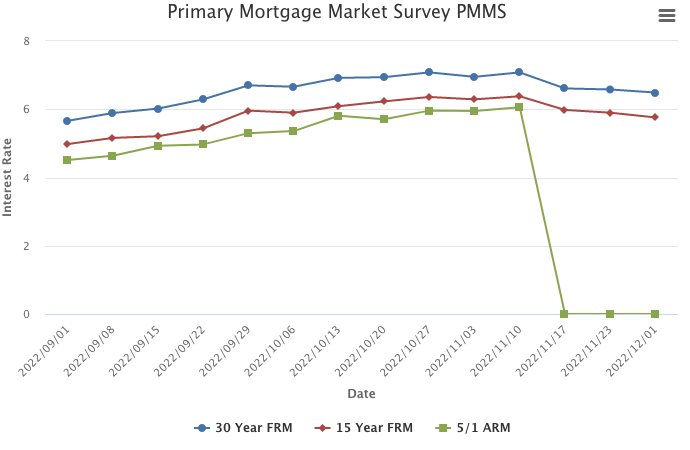

Mortgage Rates Continue to Drop

December 8, 2022

Mortgage rates decreased for the fourth consecutive week, due to increasing concerns over lackluster economic growth. Over the last four weeks, mortgage rates have declined three quarters of a point, the largest decline since 2008. While the decline in rates has been large, homebuyer sentiment remains low with no major positive reaction in purchase demand to these lower rates.

Information provided by Freddie Mac.

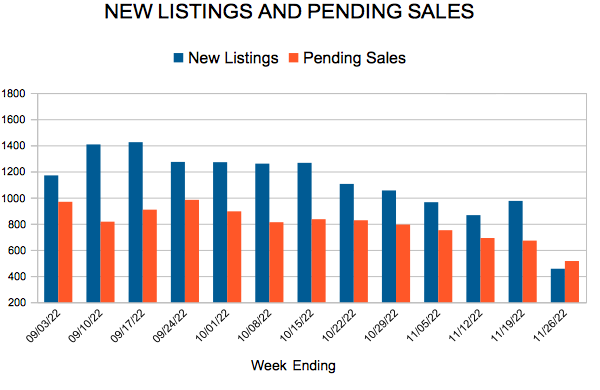

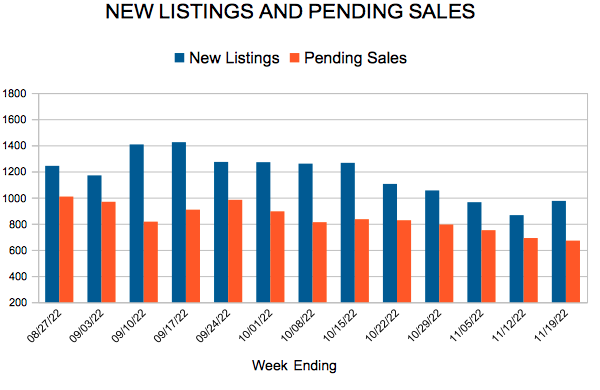

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 26, 2022

For Week Ending November 26, 2022

The share of first-time homebuyers has fallen to an all-time low, with first-time buyers making up 26% of all buyers for the fiscal year ending June 2022, while the age of the typical first-time buyer increased to 36 years old, an all-time high, according to the National Association of REALTORS® Profile of Home Buyers and Sellers, which has been published since 1981. Higher borrowing costs and a lack of affordable housing have forced many buyers out of the market this year, and inflation and rising rents have made it more difficult to save up for a down payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 26:

- New Listings decreased 10.4% to 456

- Pending Sales decreased 39.8% to 515

- Inventory increased 12.3% to 8,205

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.0% to 98.3%

- Months Supply of Homes For Sale increased 33.3% to 2.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

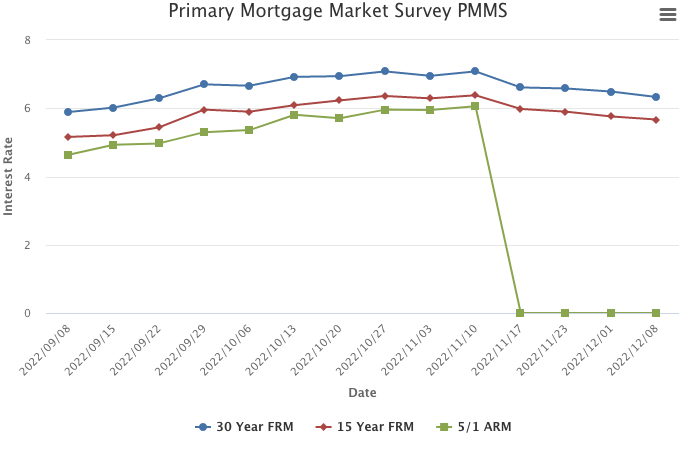

Mortgage Rates Continue to Decrease

December 1, 2022

Mortgage rates continued to drop this week as optimism grows around the prospect that the Federal Reserve will slow its pace of rate hikes. Even as rates decrease and house prices soften, economic uncertainty continues to limit homebuyer demand as we enter the last month of the year.

Information provided by Freddie Mac.